Coin-Report - Cryptocurrency and Blockchain

Bitcoin to Hit $1 Million? Presidential Elections Could Be the Catalyst

Bitcoin Price of 1 Million US Dollars Feasible Due to US Presidential Elections According to Cointelegraph Germany, Arthur Hayes, former CEO of the cr...

Bitcoin Bulls Eye 134% Growth by Year's End Amid Market Optimism

Bitcoin Bulls Stay in the Game – 134 Percent by Year's End? In a recent article by DER AKTIONÄR, the current situation and future prospects of Bitc...

XRP Eyes Breakout as SEC Legal Battle Nears Resolution

Is XRP on the Verge of a Price Breakout? SEC Proceedings Show Progress The cryptocurrency XRP, backed by Ripple Labs, is in the midst of a protracted ...

Exploring Elite Investment Trends: Why the Ultra-Rich Shun Bitcoin for Real Estate

Beyond Bitcoin: How the Ultra-Rich Invest Their Money According to a report by FOCUS Online, the wealthiest 0.001 percent of the world's population pr...

SEC Postpones Ethereum ETF Decision, Casting Uncertainty on Crypto Market Future

SEC Delays Decision on Ethereum ETFs, Impacting Market Sentiment The U.S. Securities and Exchange Commission (SEC) has once again postponed its decisi...

Ultra-Rich Favor Real Estate Over Bitcoin for Secure Investment

The Ultra-Rich Shun Bitcoin, Opt for Real Estate Investments According to a report by FOCUS Online, the world's ultra-wealthy are increasingly investi...

Ripple Challenges SEC's $2 Billion Fine as XRP Faces Crucial Legal and Market Tests

XRP-Gate: Ripple's Legal Battle with the SEC In a recent development reported by FXStreet German site, Ripple has pushed back against a staggering $2 ...

Cryptocurrency Market in Flux: Spotlight on Ethereum's Potential ETF Impact and Price Predictions

Market Analysis: Focus on Cryptocurrencies Recent movements in the cryptocurrency market show a mixed performance of leading digital currencies. Accor...

IMF Endorses Bitcoin as a Vital Asset for Financial Stability Amid Global Economic Challenges

Financial Instability: IMF Views Bitcoin as a Significant Asset Protection In a recent report, the International Monetary Fund (IMF) highlights the im...

We have compared the best crypto exchanges for you. Just take a look at our free crypto exchange provider comparison.

We have compared the leading crypto tax tool providers for you. Check out our free crypto tax tool provider comparison.

The Best Bitcoin Mining Providers at a Glance

» Infinity HashFrom our perspective, currently the best mining provider on the market. With the community concept, you participate in a mining pool completely managed by professionals. A portion of the earnings are used for expansion and maintenance. We've never seen this solved as cleanly anywhere else.

» Hashing24A well-known and established cloud hosting company. With a good entry point and in a good market phase, a good ROI can also be generated with some patience. Unfortunately, we see the durations as a major drawback.

Top 10 most read posts

Mastering Technical Analysis for Bitcoin Trading

Introduction to Technical Analysis for Bitcoin Trading Trading in the cryptocurrency world, particularly Bitcoin, requires careful decision-making and strategic planning. One...

Investment Tips for the Budding Crypto Millionaire

Introduction: An Insight into Crypto Investment If you're venturing into the promising world of cryptocurrencies, a solid investment strategy can be...

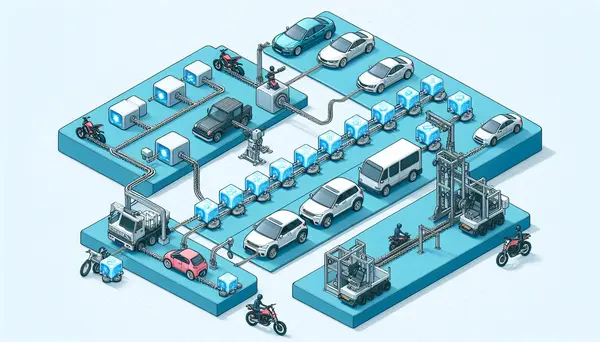

Blockchain's Influence on the Automotive Industry

Introduction: Unveiling the Power of Blockchain Blockchain technology is boldly advancing into a variety of industries, utterly transforming our occasional transactions...

Top 10 ICOs to Watch in 2023

Collateral Network (COLT) Collateral Network (COLT) is a next-generation decentralized lending platform that leverages blockchain technology to facilitate secure and efficient...

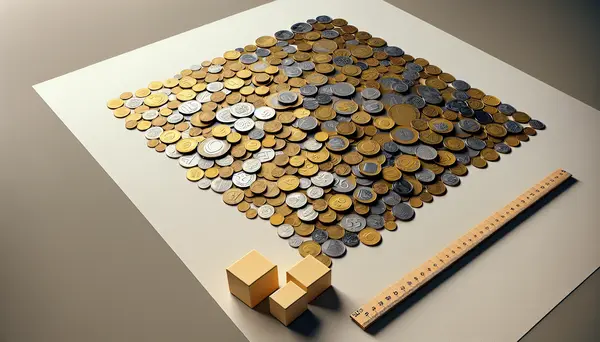

How to Build a Diversified Crypto Portfolio: A Step-By-Step Guide

Introduction: The Importance of Diversification Investing in cryptocurrencies can be both exciting and rewarding. However, it's crucial to remember that the...

Understanding ICOs: Risks, Rewards, and Regulations

Introduction to ICOs Initial Coin Offerings, often shortened to ICOs, are an increasingly popular method of fundraising for new projects in...

Bitcoin's Rise and Fall: Historical Analysis

Introduction: Bitcoin's Dynamic Journey Bitcoin, the world's first and most recognized digital currency, is often the subject of dramatic headlines, featuring...

The Role of Cryptocurrencies in Venture Capital: A New Frontier

Introduction - Understanding Cryptocurrencies and Venture Capital As technology evolves, so does our understanding of what makes a valuable asset. The...

ICO vs IPO: Which is the Better Investment?

Introduction: Understanding ICO and IPO Before delving into the difference between ICO and IPO, it's crucial to understand what these terms...

Blockchain's Potential Beyond Cryptocurrency

Introduction: Blockchain's Potential Beyond Cryptocurrency When we hear the term "blockchain," most of us instinctively think of cryptocurrencies like Bitcoin and...

- Which cryptocurrency exchanges offer the most secure storage for users' funds? 2

- What are the benefits and risks of yield farming in DeFi (Decentralized Finance)? 8

- How is the adoption of cryptocurrencies influencing traditional banking systems? 1

- How can I protect my investments from sudden price crashes in the cryptocurrency market? 6

- Can I store different types of cryptocurrencies in a single wallet? 9

- What are the advantages of using a cold storage wallet for long-term crypto storage? 2

- Do you have any favorite crypto influencers or thought leaders to follow? 7

- What are the legal implications of holding cryptocurrencies in country X? 18

- Is it possible to trade cryptocurrencies manually, or is automated trading recommended? 2

- How can I use the Ichimoku Cloud indicator in my technical analysis of cryptocurrencies? 3