Coin-Report - Cryptocurrency and Blockchain

Bitcoin Halving Countdown: Market Braces for Impact Amidst Tense Global Backdrop

Four Days Until Bitcoin Halving: What's the BTC Price Doing? With the Bitcoin Halving just around the corner, there's palpable tension in the air as m...

Turbulent Tuesday: Crypto Prices Whipsaw Amidst Market Volatility Ahead of Bitcoin Halving

Market Overview: Cryptocurrency Movements on a Volatile Tuesday Afternoon The cryptocurrency market is experiencing significant fluctuations this Tues...

Bitcoin Bounces Back: Is the $100K Milestone Within Reach Amid Market Volatility?

Bitcoin's Flash Crash and Recovery: A Market Update The cryptocurrency market has been a rollercoaster for investors, with DER AKTIONÄR TV reporting ...

XRP Eyes Monumental Surge as Ripple Targets DeFi Expansion

XRP on the Verge of Breakout: Anticipating a 3,000% Surge | finanzen.net According to finanzen.net, XRP is exhibiting a lackluster performance in the ...

Ethereum Plummets Amid Geopolitical Tensions: Understanding the Impact and Loss Potential

Ethereum Crash: Unveiling the Background and Loss Potential Recent revelations have shed light on the factors contributing to Ethereum's crash, as rep...

Bitcoin Halving Looms: Brace for Volatility or a Rally?

Bitcoin Plunges: What You Need to Know About the Bitcoin Halving The cryptocurrency world is abuzz with talk of the upcoming Bitcoin halving, an event...

Ethereum Layer-2 Adoption Skyrockets to Over 5 Million Users

Ethereum Layer-2s: More Users Than Ever Before The use of Ethereum's Layer-2 networks has reached a new peak, with the number of users increasing from...

XRP Plummets 14% Amid Market Turbulence: Is There an End in Sight?

XRP Drops by 14% - Will the Downtrend Continue? From Investing.com Deutsch The cryptocurrency XRP experienced a dramatic daily loss of 14.45%, the lar...

Bitcoin Crash Triggers Over $400 Million in Liquidations

Bitcoin Price Plummets: Market Liquidation Tops $400 Million The cryptocurrency market faced a substantial downturn over the weekend, with Cointelegra...

We have compared the best crypto exchanges for you. Just take a look at our free crypto exchange provider comparison.

We have compared the leading crypto tax tool providers for you. Check out our free crypto tax tool provider comparison.

The Best Bitcoin Mining Providers at a Glance

» Infinity HashFrom our perspective, currently the best mining provider on the market. With the community concept, you participate in a mining pool completely managed by professionals. A portion of the earnings are used for expansion and maintenance. We've never seen this solved as cleanly anywhere else.

» Hashing24A well-known and established cloud hosting company. With a good entry point and in a good market phase, a good ROI can also be generated with some patience. Unfortunately, we see the durations as a major drawback.

Top 10 most read posts

How to Build a Diversified Crypto Portfolio: A Step-By-Step Guide

Introduction: The Importance of Diversification Investing in cryptocurrencies can be both exciting and rewarding. However, it's crucial to remember that the...

Blockchain's Potential Beyond Cryptocurrency

Introduction: Blockchain's Potential Beyond Cryptocurrency When we hear the term "blockchain," most of us instinctively think of cryptocurrencies like Bitcoin and...

Understanding ICOs: Risks, Rewards, and Regulations

Introduction to ICOs Initial Coin Offerings, often shortened to ICOs, are an increasingly popular method of fundraising for new projects in...

Top 10 ICOs to Watch in 2023

Collateral Network (COLT) Collateral Network (COLT) is a next-generation decentralized lending platform that leverages blockchain technology to facilitate secure and efficient...

Bitcoin's Rise and Fall: Historical Analysis

Introduction: Bitcoin's Dynamic Journey Bitcoin, the world's first and most recognized digital currency, is often the subject of dramatic headlines, featuring...

ICO vs IPO: Which is the Better Investment?

Introduction: Understanding ICO and IPO Before delving into the difference between ICO and IPO, it's crucial to understand what these terms...

Investment Tips for the Budding Crypto Millionaire

Introduction: An Insight into Crypto Investment If you're venturing into the promising world of cryptocurrencies, a solid investment strategy can be...

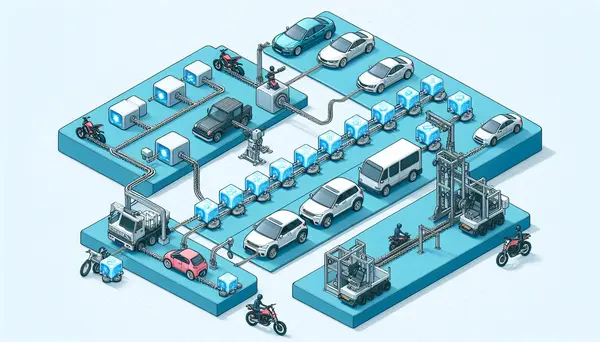

Blockchain's Influence on the Automotive Industry

Introduction: Unveiling the Power of Blockchain Blockchain technology is boldly advancing into a variety of industries, utterly transforming our occasional transactions...

The Role of Cryptocurrencies in Venture Capital: A New Frontier

Introduction - Understanding Cryptocurrencies and Venture Capital As technology evolves, so does our understanding of what makes a valuable asset. The...

Mastering Technical Analysis for Bitcoin Trading

Introduction to Technical Analysis for Bitcoin Trading Trading in the cryptocurrency world, particularly Bitcoin, requires careful decision-making and strategic planning. One...

- What was the first cryptocurrency you ever invested in and why? 8

- What are the best practices for backtesting technical trading strategies for cryptocurrencies? 3

- What are the differences between a paper wallet and a hardware wallet for storing cryptocurrencies? 3

- How can I securely store my seed phrase or recovery phrase for my wallet? 1

- How can I use Bollinger Bands in my technical analysis of cryptocurrency charts? 4

- How are use cases for cryptocurrency changing and evolving in today's world? 4

- What are some recommended resources to understand cryptocurrency regulations in different countries? 4

- How can I recover my funds if I lose access to my wallet? 2

- How are governments approaching the regulation of decentralized autonomous organizations (DAOs)? 7

- What are NFTs (Non-Fungible Tokens) and where can I learn more about them? 6